Eligibility (as defined by the Affordable Care Act (ACA) regulations):

- Active employees – Regular employees working 30 or more hours per week; Medical, Dental, and Vision ONLY

Dependent Eligibility:

Medical, Dental, and Vision benefits are available for your lawful

dependents as follows:

- Lawful spouse as defined by Arizona law.

- Children

- Natural or adopted children

- Stepchildren

- Lawfully placed foster children

- Children under the legal guardianship of the employee substantiated by a court order.

Plan Eligibility For Children

Medical/Prescription/Dental/Vision plans/Additional Life Plans-Children through the end of the month of their 26th birthday.

Effective Date Of Coverage

Insurance coverage begins on the first day of the month following 30 days of employment. Benefit premiums are paid one month in advance and deductions will likely start on your first paycheck.

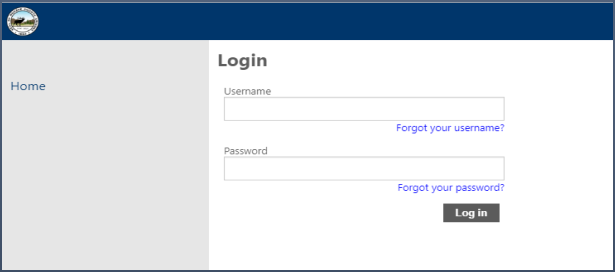

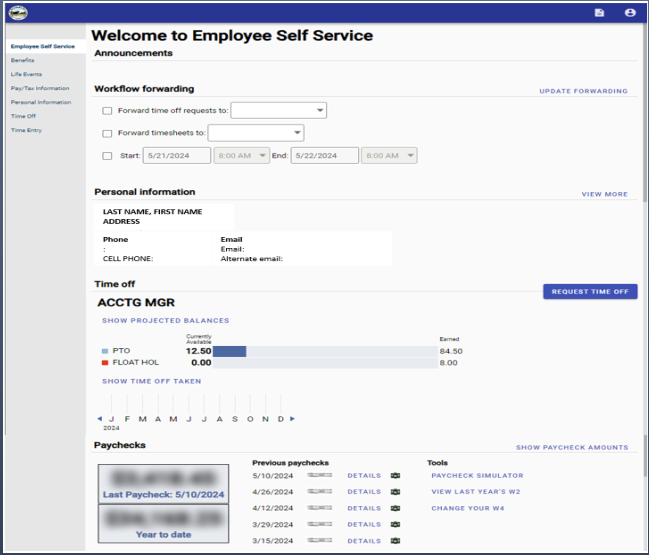

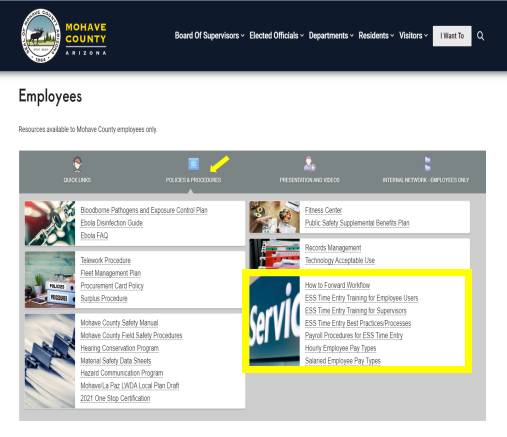

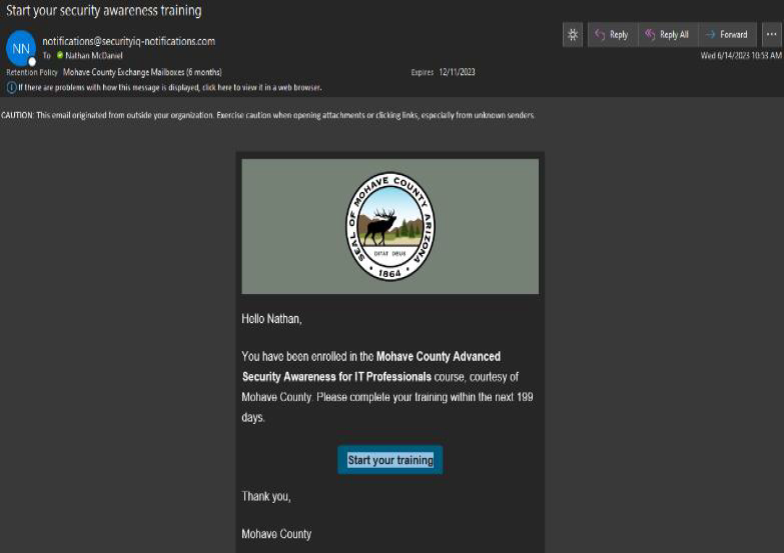

New Hire

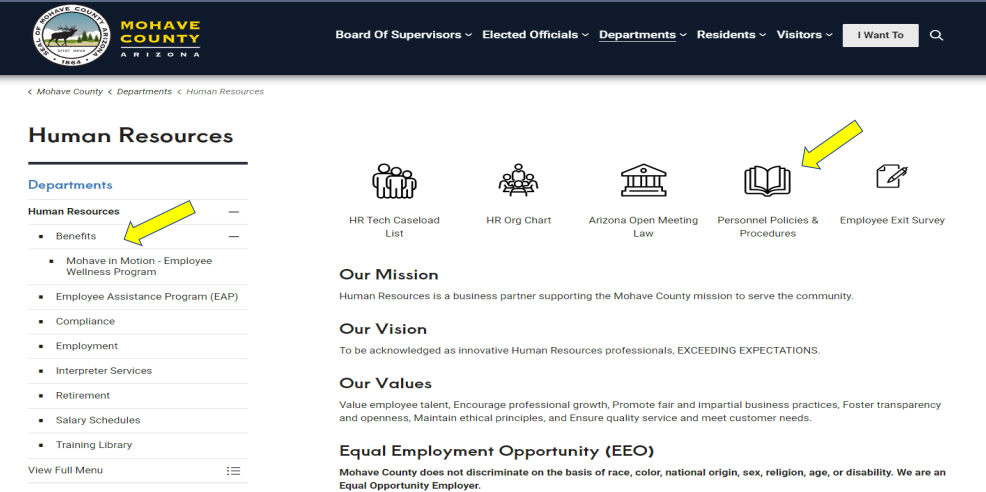

You must complete enrollment process in ESS once you have been contacted by your HR Technician. You must submit the appropriate documents to substantiate eligibility to the Plan Administrator within 31 days of hire. An employee who presents a decree ordering benefits may not add or keep the dependent on the plans if the dependent does not meet the definition of dependent.

Annual Open Enrollment

Changes may be made to your Benefit Plans during Open Enrollment each spring. The changes made during Open Enrollment will be effective on July 1st; premiums are taken one month in advance.

Qualifying Event

Changes may be made to your Benefit Plans due to a Qualifying Event. Qualifying Events are considered a change in status which can include but are not limited to; marriage/legal separation/divorce, birth or adoption of a child, and/or loss of other coverage. You have 31 days after the date of event to notify HR and make enrollment changes.

Summary Of Benefits and Coverages

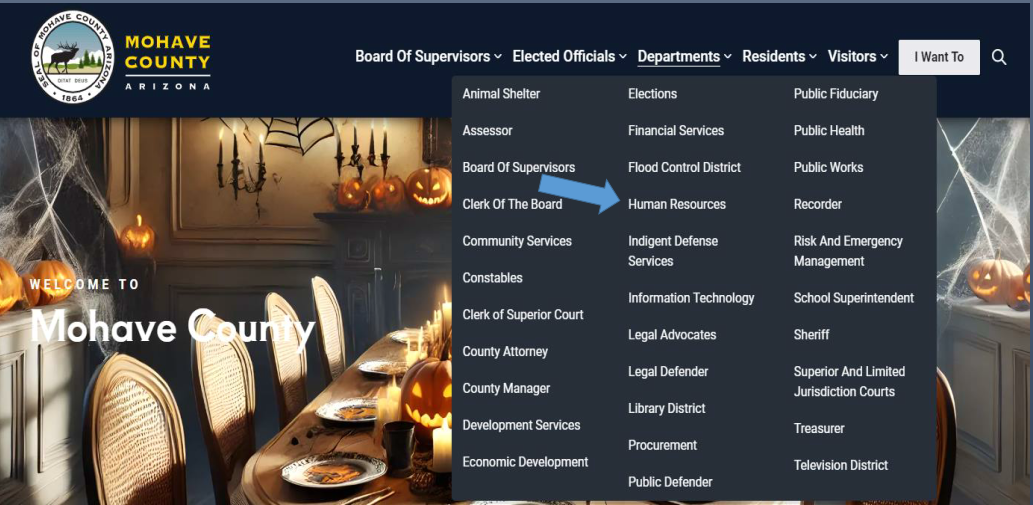

Examples of plan coverages and comparisons can be accessed online on the Mohave County HR page